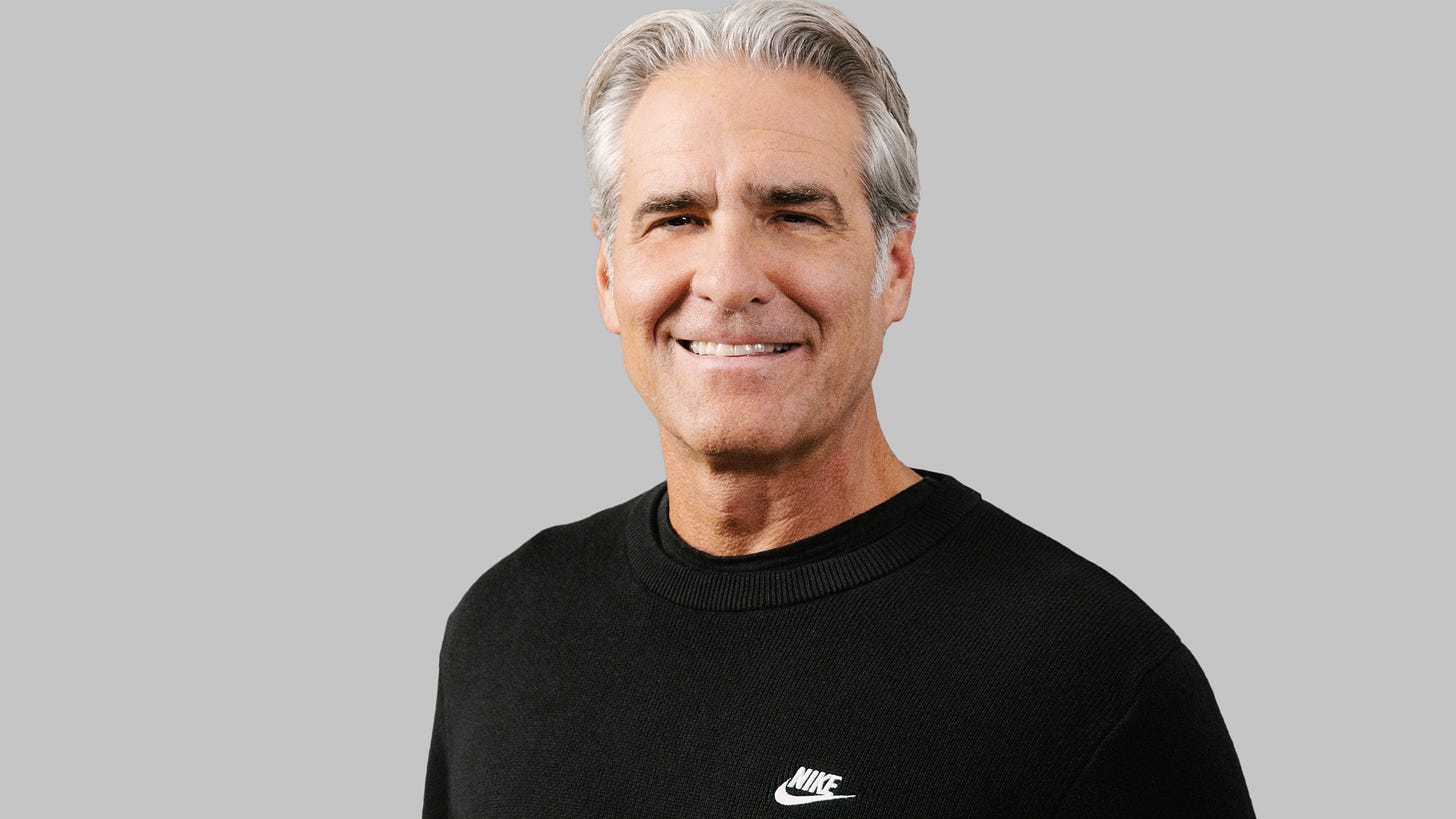

CEO Elliott Hill’s Bold Vision For Nike’s Future

60 days into his new role, Hill gave investors what they'd been craving for years: an honest assessment of the brand's predicament and what it needed to do to get back on track.

As many of you know, I covered Nike in my role as Sports Correspondent at The Business of Fashion for the last few years. Earnings calls were increasingly painful. I would get messages from insiders and analysts alike, bemoaning the previous CEO’s steadfast assertions that Nike had great things coming and the future looked bright, when clearly the brand was headed the other way.

But new CEO and Nike lifer Elliott Hill, who spent his first 60 days in the role travelling around the world visiting regional Nike teams and key retail partners to understand what the brand needed to do to get back to winning, wasted no time in setting the record straight. He started by addressing his view of how Nike ran off course and lost touch with its culture. There were five key pillars which resulted from decisions taken by the company leading up to and during the ill-fated John Donahoe Nike era between January 2020 and September 2024.

A loss of purpose. “We lost our obsession with sport. Moving forward, we will lead with sport and put the athlete at the center of every decision,” Hill said.

Short-sighted merchandising and a dependence on sales of Air Force Ones, Dunks and certain Jordan models. “A reliance on a handful of sportswear silhouettes is not who we are. We will get back to leveraging deep athlete insights to accelerate innovation, design, product creation and storytelling. Sport is what authenticates our brand.”

Damage caused by a lack of brand marketing. “I also see that we’ve shifted investments away from creating demand for our brand to capturing demand through performance marketing for our Nike digital business. We will re-invest in our brands to create stories that inspire and emotionally connect with our consumers during important sport moments and critical product launches.”

The Donahoe-era centralisation of decision-making and disempowerment of regional teams in key cities which used to drive the brand’s connection to sneaker and sports culture. “When visiting our teams around the world, it was clear, centralization has impacted the resources we have in key countries and key cities. We will rebalance, resourcing and empowering our teams on the ground to win with the everyday athletes and influencers.”

Over-reliance on DTC channels which saw Nike lose out to other brands in wholesale over the past few years. “Prioritising Nike digital revenue has impacted the health of our marketplaces. We will build back an integrated marketplace, across Nike Direct and Wholesale. Our marketplace will be consumer-led putting our best product and presentation in the path of the consumer, wherever they choose to shop.”

It was the first open, honest and frank assessment of the much-discussed causes of Nike’s decline over the past two years.

His candid take reminded me of Bjørn Gulden’s first earnings call as Adidas CEO in January 2023, when he was brought into salvage the damage caused by the company’s mismanagement of the Yeezy deal which had imploded months earlier. Gulden summarised why the brand had got things wrong, told investors to brace for challenging months ahead, set out the fundamental aspects of what an Adidas turnaround would look like, and swiftly got to work on that plan.

My good friend Jessica Ramírez, whose insights I quoted endlessly in my BoF stories, always taught me that it was crucial to tune into earnings calls. Sure, it’s easy enough to read the transcript after the fact, but on the call itself you can intuit so much more: how relaxed or confident the executive feels, their tone of voice, a sense of conviction, their relationship with the analysts on the call who get to grill them after their presentation, and whether or not those analysts buy into their strategy.

I would urge anyone with a vested interest in a public company — reporters, retailers, retail investors, shareholders, and definitely employees — to tune into earnings calls. Between all the corporate jargon there is often valuable information to uncover.

On Thursday night’s earnings call, the vibes were great‚ despite the miserable quarterly earnings Nike reported. Analysts welcomed the return of Elliott Hill as CEO with friendly banter, kind words and an understanding that though the company is in for a tough ride over the next few quarters, the new CEO is aware of where it went wrong — and how to fix it. Hill was upbeat and his passion for sports, and for Nike product, was on full display. (The same could not be said for his predecessor). Hill listed several retail partner CEOs by name who he had been to visit to convince them of Nike’s commitment to serving them better — again, a step in the right direction.

Hill’s near-term action plan for the Nike turnaround centred on the following points. He noted that “some of these actions are already underway and some need to move faster,” and that “some of these actions will have a negative impact on our near-term financial results.”

Igniting Nike’s culture through “a focus on obsession [over] sport and getting back to winning”.

“Accelerating a complete product portfolio [overhaul] driven by athlete insights.”

“Increase investment in our brand to deliver big, bold marketing statements.” (This is one element already in action under CMO Nicole Hubbard Graham, a Nike veteran who stepped away from the business but was coaxed back to lead its turnaround. I interviewed her in August about the role she played in “Winning Isn’t Everything” and getting Nike back on the front foot with its marketing.

Investing in and empowering regional and local teams in key countries and cities. (These teams took big hits under the previous management when Donahoe increasingly centralised decision making to WHQ in Beaverton, Oregon. It meant that local, on-the-ground culture teams were hit hard by numerous rounds of layoffs and re-orgs.)

“Elevate the marketplace, through a more premium Nike direct and an unwavering commitment to our wholesale partners.” Hill told investors that Nike had become far too promotional in an effort to keep up sales — which negatively impacts consumers’ perception of it as a premium brand. He also set out his vision that for Nike to return to profitable and sustainable long-term growth, it must take every effort to re-invest in its relationships with retailers, whose stores have been notably void of exciting Nike product in recent years. “Some partners and channels feel we turned our back on them. And we stopped engaging consistently,” he said.

I was encouraged by Hill’s clear and bold vision for Nike’s turnaround. He clearly cares about the business on a personal level. This was the job he had always wanted and the job he came out of retirement for after a previous 33-year stint at the Swoosh. He now has the chance to cement his legacy by being the person to lead Nike out of its biggest slump in decades.

“It feels great to be back with my Nike teammates,” he said. “This isn’t going to be easy, but we’re ready for the challenge.”

As Hill said, the next few quarters won’t be pretty, but the brand is finally putting things in place to get back on track. Plus, at $50 billion in annual revenue, Nike will be just fine.

That’s all from me on this today. I had fun. As I move into my new role in January 2025, I think I’ll continue to share my thoughts on companies like Nike, Adidas, On and Amer Sports on here and other platforms. If you liked it, please feel free to share the link with a friend and definitely let me know what your thoughts are too. And as my good friend says — any typos were intentional.

Happy Holidays!

Look forward to hearing your insights, you clearly know the space well!

Great sharing and insights, enjoyed reading this. Looking forward to Nike’s turnaround, pretty sure it’ll be a glorious comeback.